Registered onafter 1 Aug 1998. KUALA LUMPUR Nov 3 The Employees Provident Fund EPF will introduce Akaun Emas for members who are still working after the age of 55 effective Jan 1 2017.

Why Epf Is Still A Winner Despite Lowest Rate In Over Four Decades

Subject to the salarywage in Part A Third Schedule EPF Act 1991.

. Employees aged 60 years and above up to 75 years. That mean even in such conditions employer has to contribute same 12. 28th June 2012 From India Jaipur.

Pension contribution is. EPF contribution is purely optional after the member has attained the age of retirement at 58 years. Accumulated contributions can only be withdrawn at age 60.

After attaining 58 years of age EPS Contribution By Employer 833 will add to EPF Contribution By Employer. Years and after the age of 58cont8335 provident fund menas 12 of worker and 367 of emloyer on which deptt provide intt. Age 55 Years Investment Application can be made anytime.

Minimum transferred amount is RM 100000. Dividends will continue to be credited into members account until the savings are transferred to the Registrar of Unclaimed Monies after 100 years. In both the cases the Pension Contribution 833 is to be added to the Employer Share of PF.

Pension contribution not to be paid. EPF Pension which is technically known as Employees Pension Scheme EPS is a social security scheme provided by the Employees Provident Fund Organisation EPFO. When an EPS pensioner is drawing Reduced Pension and re-joins as an employee.

He said the Akaun Emas is part of the EPF schemes. 12th October 2012 From India Hyderabad. Now 95 thnaks kk advocate 21st March 2011 From India New Delhi.

However the benefits of the scheme can. In case of new employees joining after they have attained 58 years they will be exempted employees under the EPF Act and hence no contribution is payable. Upon reaching age 60 balances in Akaun 55 and Akaun Emas will be combined for withdrawal.

Cumulative contribution rate for those aged between 60-75 years is half 50 of the statutory contribution rates for both. Chief Executive Officer Datuk Shahril Ridza Ridzuan said EPFs age of full withdrawal at 55 years however remains unaffected. For both wage categories a and b above coverage has been extended from age 55 to 60 years.

The scheme makes provisions for employees working in the organized sector for a pension after their retirement at the age of 58 years. 28th June 2012 From India Chennai. In other-words he will be member of only PF.

Minimum withdrawal is RM600 RM100 per month for at least 6 months The minimum payment period is 6 months and maximum up to 12 months Registered before 1 Aug 1998. Member can contribute under Pension Scheme upto attaining the age 60 years hence you can continue his membership till he attaining the 60 yrs. The pension fund means that amount onwhich the deptt did not give interest and provided pension after the services of 10 cont.

When an employee crosses 58 years of age and is in service EPS membership ceases on completion of 58 years. Thereafter if he remains in continuing employment pension contribution will be added to his PF account. There is no age limit for PF Membership as.

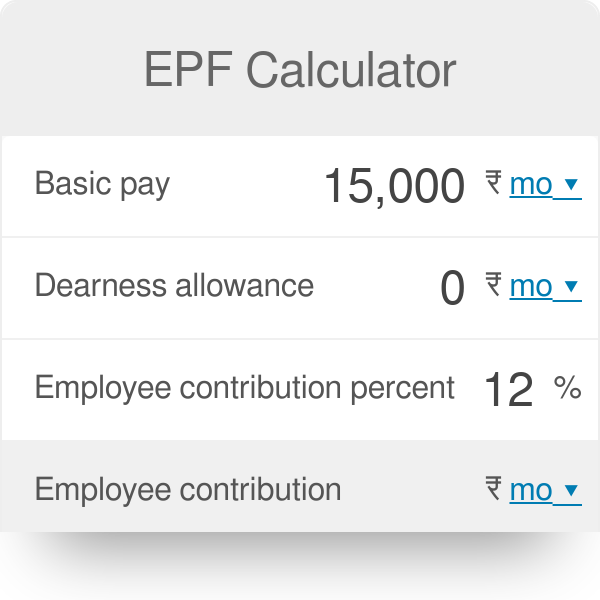

Epf Calculator Employees Provident Fund

Employee Provident Fund Epf Is Not Tax Free Anymore 60 Of Epf Withdrawals Will Be Taxed As Income Nri Sav Investment Tips Savings And Investment Tax Free

15 Best Free Epf Retirement Calculator Websites

Is There Any Restriction In Contribution To Epf For A Person Who Is In Full Time Employment Aged Above 60 The Economic Times

Steps To Maintain Current Employee Statutory Contribution Rate Asq

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

60 Million Epf Subscribers To Get 8 5 Interest Rate In Fy21 Business Standard News

Summary Of Case Study On Employee Provident Fund Of Malaysia

Epf Tax In Budget 2016 60 Pct Tax On Accrued Interest Only After April 1 2016 Budgeting Tax 60

Employers To Pay For The Damages Due To Delay In Payment Of Epf Contribution Sc Hindustan Times

Eps Vs Nps Vs Apy Retirement Benefit Comparison

Epf Contribution For Employee Age Above 60 Blog

20 Kwsp 7 Contribution Rate Png Kwspblogs

Malaysia Nominal And Real Rates Of Dividend On Epf Balances 1961 1998 Download Table

Epfo Government Of India Will Pay The Epf Contribution Of Both Employer And Employee 12 Each For The Next Three Months So That Nobody Suffers Due To Loss Of Continuity In

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Growth In Epf Subscriptions And Scale Of Operations Over The Years As Download Scientific Diagram